It’s a seven year high for the Westpac ‘ Time to buy a dwelling ‘ index, signalling a strong return for the housing market. The Westpac Bulletin in October 2020 says that ‘confidence in the housing market has boomed. The ‘time to buy a dwelling’ index increased 10.6%. As with the overall Index the result for NSW (now 120.4) was outstanding with an 11.3% rise compared to 7.0% in Victoria (now 118.0) and 4.4% in Queensland (now 118.6)’. The improvement in the index is driven largely by the low interest rate environment.

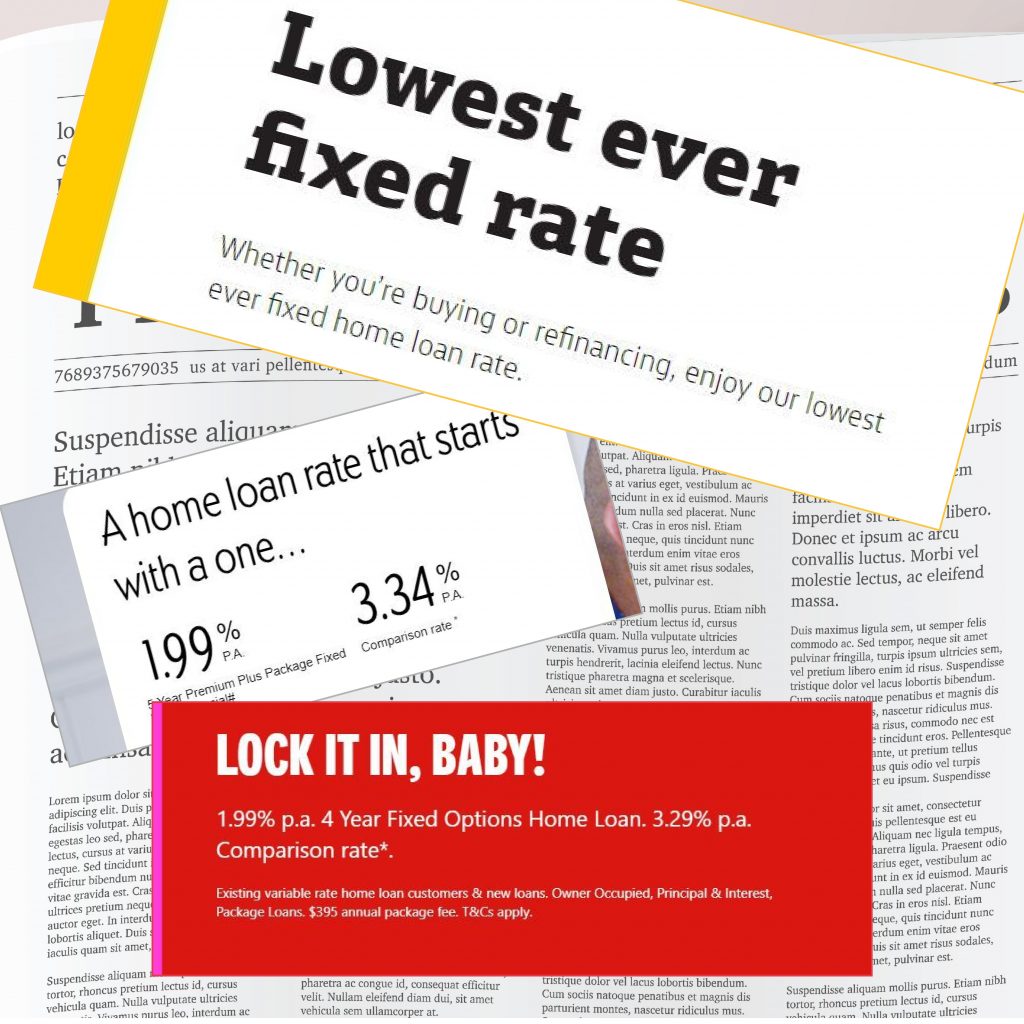

With interest rates at less than 2% fixed its making property more affordable. First home buyers are taking advantage of the low rates and government tax incentives and are very active in the market. In Newcastle properties around $500,000 to $700,000 that suit the first home buyer are in hot demand and are selling at good prices and with buyers competing strongly. The top end market in Newcastle has seen record prices reaching over $7M for a modern home opposite the beach in John Parade, Merewether. Several other sales have been reported in Ocean Street, Merewether at over $6M.

Buyers in the market are typically 52% Owner Occupiers, 25% Investors and 23% First Home Buyers.

Source : Core Logic, Westpac, Reserve Bank of Australia.