August 2021 and Forecast to 2023

Newcastle’s median house price is up 26% over the last year, to July 21, and apartment prices up 13.4%. The Newcastle median house price was $757,000 at July 21. In the same period, Sydney is showing houses prices up 19% compared to Units at 5% growth.

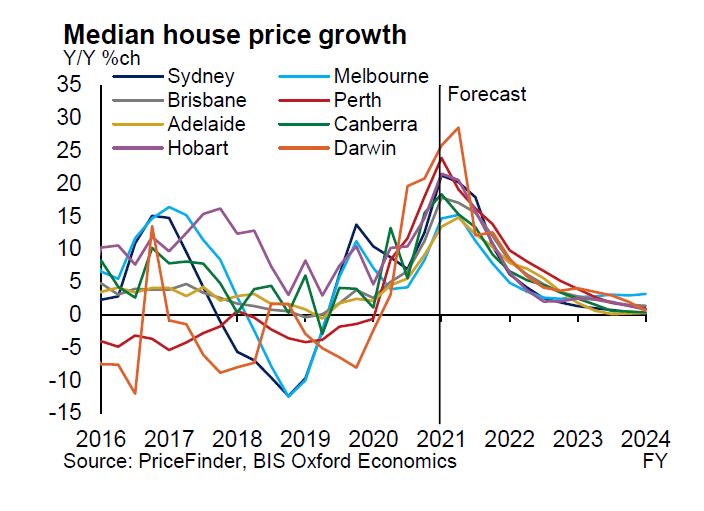

Some banks are forecasting a gain in house prices of 20% over two years, with most of the gain this year 2021. A likely surge in prices in early 2022 and followed by a flattening off in the second half of 2022, with a mild correction in 2023 as interest rates rise.

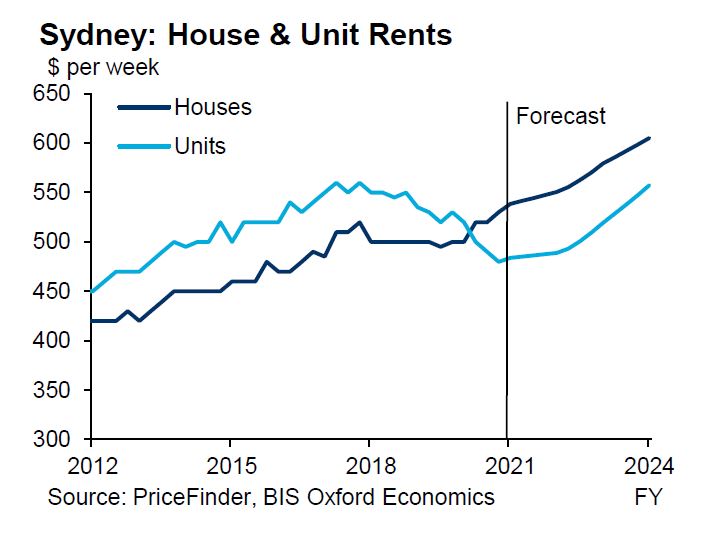

There is an expectation that Unit prices will do a catch up in price growth in the coming years. As international borders reopen and overseas migration improves.

We are seeing strong demand continuing for property in Newcastle, from; first home buyers, investors and downsizers.

Market Conditions : Head Winds & Tail Winds

- HEADWINDS

- Phase-out of fiscal support

- Migration to remain low

- Potential for credit tightening

- Early lift in interest rates

- Worsening housing affordability

- TAILWINDS

- Low interest rates

- Tightening labour markets

- Economic recovery beating forecasts

- Liquidity improves

- Vaccine rollout improves

Rental Market

Rental Prices

Rental conditions, are stronger outside of Melbourne and Sydney, and also for detached housing rather than units. This has been the case for Newcastle. Rental Growth in Sydney for houses is around +6%, with rents for Units down 1%. over last year. Generally in Newcastle houses are difficult to find to lease. New apartments just finishes in Wickham are leasing well.

Rental Yield’s

Rental Yield’s in regional NSW / Newcastle are around 4% with Sydney 2.6%.

Source : Core logic and BIS Oxford Economics

Prepared by Scott Walkom scott.walkom@wallkom.com.au August 2021